- MoneyHub

- Posts

- New Post

New Post

Good morning Today is a blank canvas—paint it with positivity. Embrace opportunities, set intentions, and make each moment count. Remember, every morning is a new beginning. Here's to a day filled with joy, productivity, and success. Make it incredible

MARKET

Microsoft CEO Nadella says OpenAI governance needs to change no matter where Altman ends up.

Microsoft CEO Satya Nadella expressed the need for a change in the governance structure of OpenAI following the abrupt firing of CEO Sam Altman. Nadella assured that Microsoft's partnership with OpenAI and AI research collaboration continues. He initially announced that Altman and colleagues would join Microsoft, but later confusion arose about their actual move. OpenAI employees demanded resignations from the board or threatened to leave for Microsoft. Nadella stated that it's the choice of OpenAI employees to stay or move to Microsoft, emphasizing Microsoft's ability to innovate independently. The possibility of Altman's reinstatement emerged as investors, including Microsoft, sought to reverse the board's decision. Nadella highlighted Microsoft's respect for OpenAI's nonprofit roots and shared commitment to safe AI development.

October CPI Report Offers Key Risk Management Lesson For Investors

-October 2023 inflation data sparked a positive reaction across the financial markets. Both stocks and bonds responded favorably as stocks ascended while bond yields plummeted, which increased prices.

Following the Bureau of Labor Statistics release of the October Consumer Price Index report, the S&P 500 ended November 1t trading higher by 1.91%, and the Nasdaq rose by 2.37%. The small caps stood out, surging by an impressive 5.44%, as represented by the Russell 2000 index. Most major asset classes found something to cheer about in the CPI.

STOCKS

Stocks are entering the next leg of the bull market and the S&P 500 can hit a record-high of 5,000 by end of 2024, veteran strategist says

Phil Orlando, Chief Equity Strategist at Federated Hermes, predicts that the bull market in stocks has further room to grow, potentially pushing the S&P 500 to a new high of 5,000 by the end of 2024, indicating a 10% upside from current levels. Orlando's optimism is based on the belief that the Federal Reserve has concluded its interest rate hikes due to a significant decline in inflation from summer highs. He notes that the bond market's recent surge in yields gives the Fed the flexibility to refrain from further rate hikes and allow a gradual inflation slowdown. The S&P 500 has risen 7% in November, reaching around 4,535, and Orlando suggests the rally could extend into 2025 and 2026, particularly if the upcoming election cycle encourages market-friendly policies. Markets currently assign an 81% chance of a Fed rate cut in the first half of the next year.

Warren Buffett's company has built a record $157 billion cash pile so he can capitalize when the economy tanks, veteran professor Steve Hanke says

-Warren Buffett's Berkshire Hathaway has accumulated a historic $157 billion in cash and Treasuries, signalling his readiness to capitalise on potential economic downturns. According to economist Steve Hanke, Buffett's strategy is to navigate troubled economic waters, leveraging his cash reserve to secure bargains and strike lucrative deals during crises. The cash pile, increased by nearly $50 billion in 12 months, positions Buffett to invest in discounted stocks and businesses, and lend money at attractive rates if the economy weakens. The move aligns with Buffett's past successes during financial crises, where he deployed substantial capital for profitable transactions. Despite warnings from some commentators, Buffett's approach reflects his confidence in seizing opportunities amid economic challenges. The cash buildup also allows him to earn solid returns with zero risk while awaiting favourable investment conditions.

CRYPTO

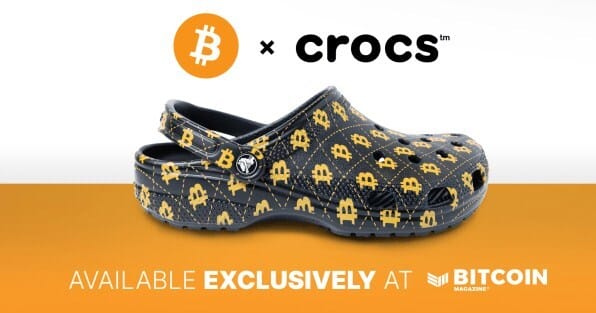

Bitcoin Magazine Launches Bitcoin Crocs.

Bitcoin X Crocs: Bitcoin Magazine is releasing a limited run of the first and only Bitcoin Crocs shoe. The sound money footwear is crafted in the iconic Crocs clog style and features the classic orange Bitcoin logo atop a black base color. Each of the 2,100 pairs of Bitcoin Crocs will come with a custom Bitcoin Magazine logo Jibbitz™.

Bitcoin Magazine President Mike Germano noted the relevance of Crocs to the Bitcoin brand, saying: “Just like Bitcoin, people have said Crocs are dead for many years, only to be proven wrong time and time again. After all, Bitcoin and Crocs both have passionate communities. We wanted to recognize that by releasing Bitcoin Crocs for both to enjoy.”

Bitcoin Magazine is the exclusive merchant for the new Bitcoin Crocs Collection produced in a partnership between Bitcoin Magazine and Collect and Hodl, the progenitor of the Bitcoin Pez Dispenser.

The pre-sale begins Monday 11/20 and will be capped at 2,100 pairs produced for magic internet money enjoyers and comfort-minded podiatric connoisseurs alike.

Later this year Bitcoin Magazine will be offering a 5 pack of Bitcoin-themed Jibbitz™, with designs to be announced and revealed at a later date.

Bittrex Global Ceases Trading Amid Operations Wind Down

-Bittrex Global is set to cease its trading operations globally on Dec. 4, following its U.S. arm’s legal settlement with the SEC and an ongoing complex regulatory landscape.Bittrex Global has announced the closure of its global operations. The announcement comes shortly after the shutdown of company’s U.S. arm, which faced legal challenges from the U.S. Securities and Exchange Commission (SEC).

As of Dec. 4, Bittrex Global will cease all trading activities, transitioning solely to allowing asset withdrawals for its customers.

REAL ESTATES

Signature Bank’s Apartment Loans Selling at a Steep Discount

A joint venture between two nonprofits and Related Fund Management is set to secure a winning bid in the auction for Signature Bank loans backed by New York apartments, with a bid of less than 70 cents on the dollar, reflecting the declining value of the city's rent-regulated apartment sector. The $33 billion sale, conducted by the Federal Deposit Insurance Corp. (FDIC), marks the largest commercial real estate transaction of the year. New York state legislation and higher interest rates have contributed to the reduced value of rent-regulated buildings. The auction, involving assets from the failed bank, includes both rent-regulated and nonregulated commercial properties, with Blackstone and Rialto Capital emerging as leading bidders for some Signature assets. The sale is crucial in determining the extent of the decline in property values. The FDIC plans to retain a 95% stake in the rent-regulated pools to preserve affordability and potentially share in profits from a future rise in property values. Signature Bank failed in March, and the FDIC's sale is a significant event in the real estate market.

BUSINESS

The Shake-up at OpenAI Reshapes the Industry’s Global Order

Over just three days, the landscape for artificial intelligence has been reshaped drastically. On Friday morning, Sam Altman was the C.E.O. of OpenAI, the leader in commercializing generative A.I. through ChatGPT. By Monday, he had not only been fired by his board — he had also joined Microsoft, the start-up’s biggest backer. What happened is more than just a juicy corporate tale. At stake are the fates of major A.I. players like OpenAI and Microsoft. And it’s a reminder of serious divides within the A.I. community —and questions about how that industry is led.

ECONOMIC

Argentina’s New President Wants to Adopt the U.S. Dollar as the National Currency

BUENOS AIRES—The self-styled anarcho-capitalist who won Argentina’s presidency on Sunday plans to ditch his nation’s peso and adopt the U.S. dollar as the national currency.

President-elect Javier Milei’s top campaign proposal was aimed at eradicating rampant inflation that has for decades ravaged Latin America’s third-biggest economy by removing the battered national currency from circulation and stripping the central bank of its power to print money. Uncontrolled money-printing to cover public expenditures, economists say, has fueled 143% inflation, one of the world’s highest.

FINANCE

Stocks making the biggest moves midday: Microsoft, Chegg, Zoom Video, Paramount and more

Zoom Video Communications (ZM):

Added 2.9% ahead of Q3 earnings.

Analysts expect $1.08 per share in earnings and $1.12 billion in revenue.

Paramount Global:

Shares rose 5.6% after the Professional Fighters League completed the acquisition of Bellator from Paramount.

Penn Entertainment:

Jumped 6.8% following a Bank of America upgrade to buy.

ESPN Bet, the company’s new sportsbook, expected to boost shares.

Spectrum Brands Holdings:

Shares dipped 2.5% after a Wells Fargo downgrade, citing less conviction about fundamentals.

Microsoft:

Shares increased by 2% after announcing former OpenAI CEO Sam Altman and Greg Brockman will lead a new AI research team.

Thank you

I want to express my sincere thanks for being part of our awesome newsletter community. Your ongoing support and enthusiasm fuel our passion for creating meaningful content. Thanks for letting us into your inbox! Excited to catch up with you again tomorrow for more news and updates!